does texas have state inheritance tax

Its inheritance tax was repealed in 2015. If your inheritance is in Trust a portion of the income.

Texas Estate Tax Everything You Need To Know Smartasset

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

. While Texas doesnt have an estate tax the federal government does. Right now there are 6 states that have an inheritance tax. On the one hand Texas does not have an inheritance tax.

Texas Have Inheritance Tax. There is also no inheritance tax in Texas. Inheritance taxes which are calculated based on who inherits the estate as opposed to the overall value of the estate are currently collected in the states of Iowa Kentucky Maryland Nebraska New Jersey and PennsylvaniaNotice that Maryland and New Jersey collect both state estate taxes and inheritance taxes.

Therefore if you inherit possessions property to sell or keep or money from a loved one in Texas you most likely wont need to pay any tax. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. Even though some states have inheritance taxes as low as 1 Texas still follows the federal estate tax rate based on inflation numbers of 515 million to avoid estates tax.

Your estate may be subject to the federal estate tax While there is no state inheritance tax in Texas your estate may be subject to the federal estate tax. This is because the amount is taxed on the individuals final tax return. Even though no state inheritance taxes are imposed some estates are subject to federal estate taxes.

Iowa Kentucky Nebraska New Jersey Maryland and Pennsylvania. There are not any estate or inheritance taxes in the state of Texas. Texas also imposes a cigarette tax a gas tax and a hotel tax.

Parents siblings and other close relatives can inherit 40000 tax-free and pay just 1 of the market value of inherited property over that amount. Collected from the entire web and summarized to include only the most important parts of it. That is not true in every state.

For example in Pennsylvania there is a tax that applies to out-of-state inheritors. Texas has no inheritance tax so any money you receive as a beneficiary is not charged state tax income tax property tax or capital gains tax. However a Texan resident who inherits a property from a state that does have such tax will still be responsible for paying the relevant tax due.

First there are the federal governments tax laws. However other stipulations might mean youll still get taxed on an inheritance. Theres no personal property tax except on property used for business purposes.

Maryland is the only state to impose both. Iowa Kentucky Nebraska New Jersey and Pennsylvania have only an inheritance tax that is a tax on what you receive as the beneficiary of an estate. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

The sales tax is 625 at the state level and local taxes can be added on. The state of Texas does not have any inheritance of estate taxes. Rather a portion of the federal estate tax equal to the allowable state death tax credit on the federal estate tax return was deducted from amount due to the federal government and paid to Texas.

Before 1995 Texas collected a separate inheritance tax called a pick-up tax The tax did not increase the total amount of estate tax paid upon death. There is a 40 percent federal tax however on estates over 534 million in value. That said you will likely have to file some taxes on behalf of the deceased including.

Impose estate taxes and six impose inheritance taxes. The state repealed the inheritance tax beginning on September 1 2015. Can be used as content for research and analysis.

Kentucky for example taxes inheritances at up to 16 percent. Youre in luck if you live in Texas because the state does not have an inheritance tax nor does the federal government. The top inheritance tax rate in any state is 18.

FEDERAL ESTATE TAX RATES Taxable Estate Base Taxes Paid Marginal Rate Rate Threshold 1 10000 0 18 1 10000 20000 1800 20 10000 20000 40000 3800 22 20000 40000. What are the estate tax rates in Texas. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

There are no inheritance or estate taxes in Texas. Twelve states and Washington DC. Understanding how Texas estate tax laws apply to your particular situation is critical.

Spouses and certain other heirs are typically excluded by states from paying inheritance taxes. Texas is one of a handful of states that does not have an inheritance tax. However if a loved one gifts you something elsewhere in the country you may need to pay that states inheritance tax.

Many states have an inheritance tax that must be paid in addition to the federal estate tax but not Texas. Some states have enacted inheritance taxes on estates of any size. More distant relatives pay 13 for amounts over 15000 and.

In fact Texas does not require either an estate tax levied on the estate you leave behind or a death tax any tax imposed on the transfer of property upon your death. State Inheritance Taxes. Texas does not have a state estate tax or inheritance tax.

The state repealed the inheritance tax beginning on 9115. Texas repealed its inheritance tax law in 2015 but other tricky rules can apply depending on what you do with the money or property. Maryland is the lone state that.

Additionally the state no longer has an inheritance tax which means that if your loved ones inherit from you they will not be taxed on the assets they receive. If you live in one of the states levy inheritance Tax. Does Texas Have an Inheritance Tax or Estate Tax.

Texas Inheritance Tax and Gift Tax. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as estate taxes without the. Non-relatives pay 18 on amounts over 10000.

Each state has its own tax brackets and rates though the rate is usually between 15 percentage and 20 percentage. And in. The short answer is no.

There is a 40 percent federal tax. There are no inheritance or estate taxes in Texas. Each are due by the tax day of the year.

Someone will likely have to file some taxes on your behalf after your death though including the following. With the exception of the estate tax for estates exceeding 1158 million dollars per person California does not have a state-level inheritance tax. Final individual federal and state income tax returns.

The single person who dies in 2018 will receive 6 million and the family of. The final federal and state tax returns as well as the federal estatetrust income tax return are all due by tax day of the year following your death. However other states inheritance taxes may apply to you if a loved one who lives in those states gives you money so make sure to check that states laws.

There is a 40 percent federal tax however on estates over 534 million in value. When does inheritance become taxable. Texas has no income tax and it doesnt tax estates either.

While most states in the United States have an inheritance tax Texas doesnt.

Historical Texas Tax Policy Information Ballotpedia

International Tax Lawyers Houston Texas Http Bit Ly 2gic5ik Tax Lawyer Tax Attorney Creative Thinking Skills

Texas Has The Fifth Highest Property Taxes In The Nation But Do We Get What We Pay For Candysdirt Com

Texas Inheritance Laws What You Should Know Smartasset

States That Won T Tax Your Retirement Distributions Income Tax Income Tax

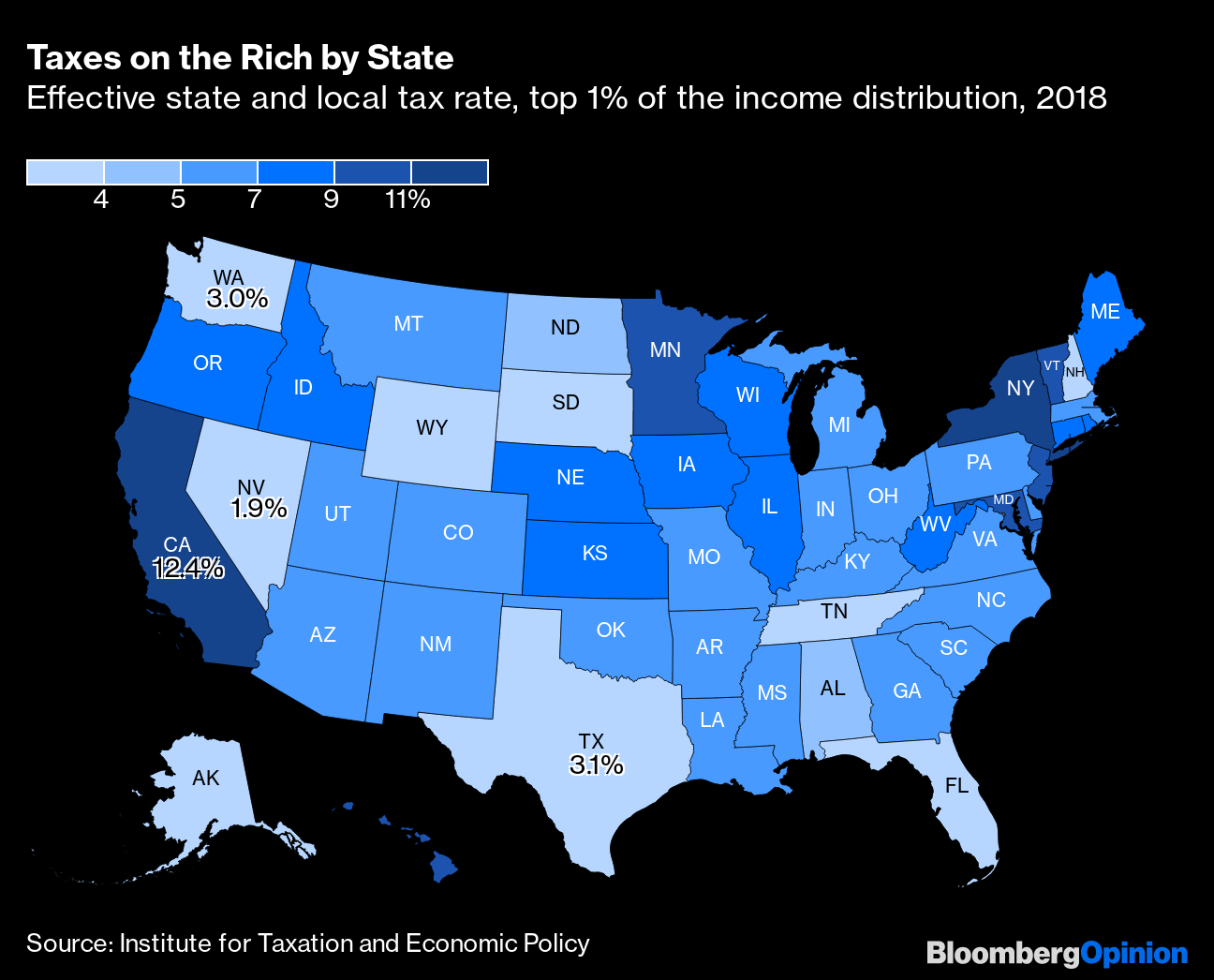

Wait California Has Lower Middle Class Taxes Than Texas Bloomberg

Wait California Has Lower Middle Class Taxes Than Texas Bloomberg

What Is An Executor Probate Texas Estate Administration

Grandma Wants To Give Me 120k For A House She Has Not Met The 5 45 Million Lifetime Pre Tax Limit What Is Taxable In This Situation Tax Lifetime Gifts Tax Forms

Home Buying Tax Deductions What S Tax Deductible Buying A House Tax Deductions Real Estate Estate Tax

Texas State Taxes Forbes Advisor

Texas Inheritance And Estate Taxes Ibekwe Law

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Davenport S Texas Wills And Estate Planning Legal Forms Paperback Walmart Com In 2022 Estate Planning Legal Forms How To Plan

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Estate Personal Property Inventory Form Unique Texas Inheritance Tax Forms 17 100 Small Estate Return Inheritance Tax Personal Property Job Letter

Inheritance Taxes Family Law Attorney Divorce Lawyers Divorce Attorney

.jpg)